Until the COVID-19 pandemic, the real estate market in the Chicago area was trending upwards, however, the economic landscape throughout the country now is uncertain. This leaves homebuyers, sellers, and investors wondering what the future may hold for the real estate market in the wake of these changes.

Home buying demand exceeds inventory

As some states lift shelter-in-place orders and reopen businesses, the home buying demand is making a comeback, and according to recent studies by Redfin, sales are only down 15% from pre-pandemic levels. Potential sellers shouldn’t rejoice quite yet, however. There is currently a lack of inventory on the market for new homebuyers, not to mention record low home loan interest rates, but this does not mean it will be much easier to sell homes. The major factors that contribute to the home’s sale-ability are the available inventory in the area and the price bracket of the property.

Why is the inventory so low? For one, many would-be sellers have decided to hold off on listing their property until states fully open up again in hopes of being able to ask for a higher price. Additionally, many sellers with homes currently sitting on the market without much interest from buyers have opted not to lower the prices, but to simply delist their homes and wait to relist once they feel they may have a better outcome.

The good news for sellers listing a home that fits into an affordable starter home category (one that does not require special financing such as a jumbo loan) is that the demand for these homes is still outweighing the supply, even in the midst of a pandemic. The fate of the high-end of the market is a little bit more complicated. The supply of higher-end homes (homes over $1 million) is extremely limited at this point in time, which is usually good news for home sellers. However, it has become far more difficult for the potential homebuyers to secure financing. Now, many banks are enforcing stricter lending guidelines such as requiring heftier down-payments and higher FICO scores, which can drastically affect a homebuyer’s budget. For example, if they were planning on making a 10% down payment on a home (which according to Redfin data includes nearly half of all Americans who financed a home in 2019), but could not afford the 20% down payment a lender may now require, the buyer would either have to rethink their budget or wait on purchasing a new home.

Home foreclosures decline, but is it temporary?

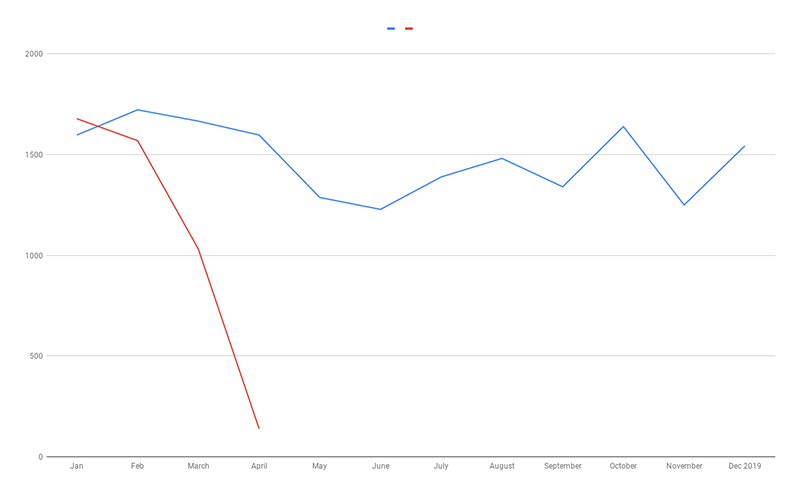

What does this mean for home foreclosures? According to ILFLS date, at the beginning of the year, the monthly number home foreclosures in the seven counties increased about 8.75% in January 2020 versus that of January 2019, but began to decline and actually decreased to 6.5% fewer foreclosures in February 2020 than in February 2019. Of course when COVID-19 struck the foreclosure numbers became nearly non-existent with court closures as well as mortgage forbearances and other economic aid in place during shut-downs.

For those looking to invest in foreclosed property, this is not to say that the numbers will continue to remain low or decline compared to 2019. After the country reopens and Americans adjust to job-loss, salary changes, and overall economic strains, the number of homes for sale or in foreclosure may rise significantly.